IN THE NEWS

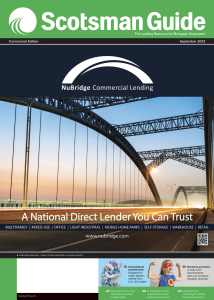

See NuBridge on the Cover of Scotsman Guide

Check out NuBridge Commercial Lending on the cover of Scotsman Guide’s September 2023 issue.

Cadence Business Finance Agents $73.5 Million Revolving Credit Facility for NuBridge Commercial Lending

NuBridge Commercial Lending Completes Credit Facility with Cadence Business Finance

Fill out o DIAMOND BAR, Calif. – NuBridge Commercial Lending LLC, a small-balance commercial bridge lender, announced today its completion of a new senior secured revolving credit facility with Cadence Business Finance, a division of Cadence Bank. The initial size of this 36-month committed credit facility is $20 million and is expected to grow to at least $50 million.

Trive Capital Partners with Experienced Management Team to Launch NuBridge

LOS ANGELES COUNTY, Calif. and DALLAS, Aug. 27, 2020 – Trive Capital (“Trive”), the Dallas-based private equity firm, is excited to announce the recent formation of NuBridge Commercial Lending LLC (“NuBridge”). Trive has partnered with an experienced management team to form NuBridge and build out a real estate platform focused on making first-lien, short-term bridge loans for commercial and multifamily properties across the United States.